Carbon Accounting

The reality of accounting for carbon-related instruments

In response to demands to tackle climate change, an increasing number of companies across the world are participating in carbon markets to reduce their carbon emissions, either because of national or supranational regulations or purely by choice.

In broad terms, within these carbon markets, carbon emissions are priced, and companies are able to reduce their carbon footprint by trading carbon-related instruments (such as carbon allowances and credits) which are connected to carbon emissions.

Research by ACCA and the Adam Smith Business School of the University of Glasgow found that the variety of terms and accounting treatments for carbon-related instruments can cause complexity.

The findings suggest that companies need guidance for consistent accounting and reporting of carbon-related instruments. Such guidance will benefit from input by a broad spectrum of stakeholders.

The importance and magnitude of mandatory and voluntary carbon markets has been growing at an unprecedented pace. An increasing number of companies have participated (mandatorily or voluntarily) in carbon markets and use a variety of such instruments.

The prices of some of these instruments have been increasing and could cost more in the future. Indicatively, in 2023 one metric tonne of carbon emissions in the European Union Emissions Trading System (EU ETS) was priced at €83.66, which reflects an increase of more than 3.3 times the 2020 prices. The price is subject to fluctuation and, at the time of writing this article, had fallen to €66.970. However, some market predictions – notably Carbon Pulse - see the price rising to €100 or more at some point between 2026 and 2030.

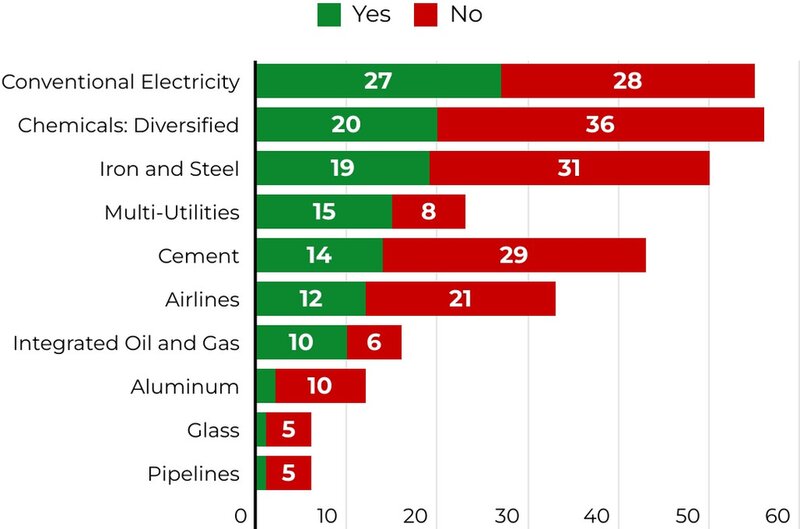

ACCA and the Adam Smith Business School of the University of Glasgow examined the annual reports of 300 companies in ten subsectors around the world and observed at least 11 terms being used within and across companies’ annual reports to describe instruments in carbon markets.

The variety of terms causes complexity when no definitions are given for these terms and their descriptions are often vague. While some terms are frequently associated with one type of carbon market, such as ‘allowance’ with the compliance carbon market, and ‘credit’ with the voluntary carbon market, these associations are not always obvious. In this research, these instruments are collectively described as ‘carbon-related instruments’.

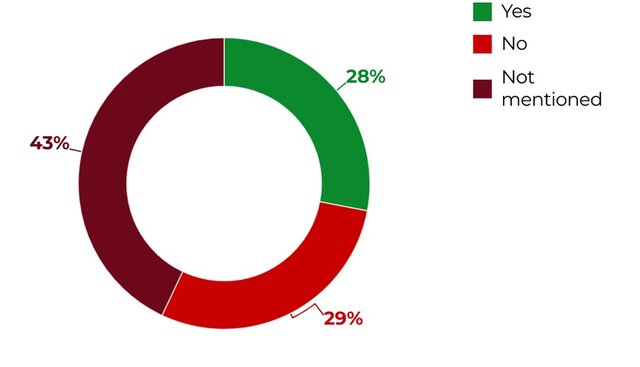

Among the 300 companies, only 84 (i.e 28% of our sample) disclose in the annual reports their participation in a carbon market, even though these companies operate in subsectors with high carbon emissions, while 20 companies express their interest in participating in a carbon market in the future.

Only 121 companies (40% of the sample) refer to carbon-related instruments in their financial statements. These companies, and thus their engagements with carbon-related instruments, are not concentrated in any subsectors.

Engagement with carbon-related instruments is not yet pervasive but may grow.

Engagement with carbon-related instruments are not concentrated in any subsectors.

Currently, there is no IFRS Accounting Standard or guidance dedicated to accounting for carbon-related instruments. Consequently, companies have had to develop their own accounting policies to account for these instruments as either assets, liabilities, income or expenses. As a result, several accounting treatments are observed across companies.

On the assets side, these instruments are most often accounted for as ‘intangible assets’, followed by ‘inventories’ and ‘financial assets’. Some companies presented these instruments as ‘other assets’. Further, these instruments are measured at cost or at fair value (or a combination of both approaches). Some companies do not disclose their measurement approach at all. On the liabilities side, some companies recognise provisions on a gross basis, while others do so on a net basis.

The size of these instruments, as a percentage of total assets or revenues, varies considerably among companies without being significant for all companies. This indicates that the instrument’s magnitude is not the sole determinant for recognition and disclosure in the financial statements. Nevertheless, there is room for improvement to provide information in the financial statements about these instruments’ nature, function, intended use, useful lives, amounts and accounting policies to help users understand their relevance and financial effects on the company.

Relatively few auditors’ reports discuss issues around carbon-related instruments. Those that do tend to discuss issues relating to the exercise of judgement or the use of assumptions, such as accounting for carbon-related instruments, measurement of these instruments, impairment tests for assets, and changes in accounting policy.

It’s about keeping employees interested in the firms they work for and retaining good talent so that they can continue to grow with, and add value to, the company. After investing in the skills to develop good people, we want to strengthen work environments that keep them.

Companies need globally applicable guidance for consistent accounting treatment of carbon-related instruments

Considering the growing importance of carbon markets and associated accounting for carbon-related instruments, good quality information about such instruments would benefit a broad spectrum of stakeholders in the corporate reporting ecosystem.

Therefore, companies need globally applicable guidance for consistent accounting and reporting of carbon-related instruments. Such guidance should help determine:

- the appropriate scope when accounting for each carbon-related instrument that faithfully represents its nature, function and intended use

- when and how to recognise the instrument

- the appropriate measurement approaches, and

- relevant disclosures to enable users to evaluate the financial effects of such an instrument on the company, including its nature, function and intended use.

The reports made specific recommendations for key stakeholders.

Preparers of financial statements

Preparers should take proactive measures to:

- clearly state their accounting policies for the recognition and measurement of carbon-related instruments

- clearly describe the nature, function and intended use of their carbon-related instruments

- provide information about carbon-related instruments in a coherent manner in the financial statements and the narrative part of an annual report

- collaborate with peers to promote consistency of accounting treatments, in particular with peers who share a common purpose of engaging with carbon-related instruments, and

- share best practices to support their peers in the subsector.

Standard-setters, policymakers and regulators

IASB have a major future role in developing a dedicated accounting standard with appropriate definitions and requirements for the recognition, measurement and disclosure of carbon-related instruments, and in supporting consistent application of the resulting accounting and disclosure requirements. Standard-setters need to be supported by policymakers and regulators to improve the overall consistency of accounting treatments and disclosure of carbon-related instruments and thus the comparability of financial statements. Therefore, this group of stakeholders should:

- periodically scan the horizon to monitor the evolving state of play among companies around the world, and consider proposals or white papers produced by other standard setters or other reporting-related bodies

- facilitate collaboration and discussion among stakeholders in corporate reporting

- work collaboratively at national, regional and international levels to:

- develop a truly global accounting standard to support consistent accounting treatments across all jurisdictions

- uphold the credibility of carbon markets and associated instruments

- provide general guidance on disclosures.

Users and those charged with governance

Users and those charged with governance should:

- familiarise themselves with carbon markets and carbon-related instruments to understand what companies do with these instruments and why

- steer companies towards providing coherent information

- engage with standard setters and relevant policymakers and regulators to provide inputs about the information they need for decision-making, why they need this information, and how they will use.

Auditors

Auditors should:

- check the coherence of information in the financial statements and the narrative part of an annual report, and

- lend their technical expertise to support the development of globally applicable guidance for consistent accounting treatment of carbon-related instruments, and to help ensure the resulting accounting and disclosure requirements are auditable.

See here for the full report.

Main image: Aaron Saw, head of Corporate Reporting Insights – Financial, ACCA