Auditor Path

From trainee to partner: the role of an auditor

At the start of last month, Crowe UK announced the promotion of Matthew Howard to corporate audit partner, after joining Crowe as a trainee back in 2007. The Accountant caught up with him to find out his thoughts on the changing role of the auditor and his practical insights for those at the start of their careers.

Akey emerging challenge for the oversight of capital market across the globe is how to incorporate an appropriate oversight regime for the assurance of sustainability-related disclosures.

Those who have been involved in audit and its regulation for any time know the complexities and challenges that financial disclosures can pose for regulatory oversight. The rapidly emerging and growing sustainability assurance markets poses equally tough if not tougher questions.

A sustainability assurance regime does not exist in isolation. Any framework needs to be placed in a wider context of supporting wider economic objectives promoting long-term economic growth, increasing investment, and strengthening financial and professional services.

In its recent submission to the UK government’ Department for Business and Trade (DBT) consultation on developing an oversight regime for the assurance of sustainability-related financial disclosures, ACCA said that the assurance regime should enhance the quality, consistency, and credibility of sustainability disclosures which will improve investor access to reliable, decision-useful information. This is essential for mobilising private capital toward productive, innovative, and sustainable sectors.

Governments and regulators are increasingly focused on building market confidence in sustainability information to support the transition to a greener economy. For policymakers an effective sustainability assurance regime must deliver several key outcomes including trustworthy and comparable sustainability disclosures, clear accountability for assurance providers and alignment with international standards.

While ACCA advocates for global standards to improve trust and consistency in accounting we recognise that achieving this can be difficult in emerging areas. Jurisdictions are taking different approaches: while the UK has been consulting on a voluntary regime, other jurisdictions are moving to mandatory requirements. The European Union, for example, through the Corporate Reporting Sustainability Directive (CSRD), and Australia and New Zealand are introducing mandatory requirements using a phased mandatory reporting. Although others - notably the US are moving in the opposite direction.

However, this divergence largely relates to reporting requirements rather than assurance standards. In the area of sustainability assurance, there are currently few local standards, with most jurisdictions expected to rely on global frameworks such as the IAASB’s newly developed standard ISSA 5000 or ISAE 3000 (Revised) in the interim.

Whatever the status, any sustainability oversight regime should include mechanisms to assess whether sustainability assurance providers - regardless of background - demonstrate core skills and competencies ensuring there is a level playing field by applying consistent requirements for competence, ethics, and quality management.

Joe Fitzsimons

Leads ACCA policy work across Europe, Eurasia, the Americas, Middle East and the UK. He was formerly a member of the policy team at the Institute of Directors, where he led across a range of policy areas, including education and skills, EDI, and SME support.

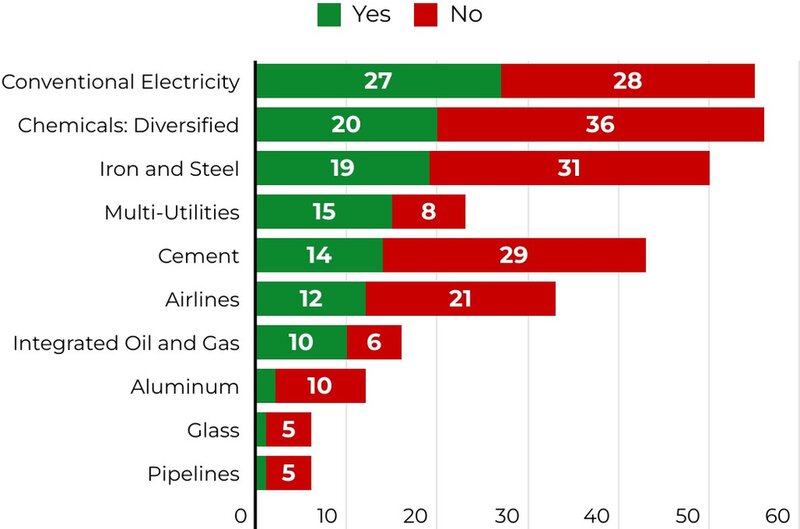

Engagement with carbon-related instruments are not concentrated in any subsectors.

Currently, there is no IFRS Accounting Standard or guidance dedicated to accounting for carbon-related instruments. Consequently, companies have had to develop their own accounting policies to account for these instruments as either assets, liabilities, income or expenses. As a result, several accounting treatments are observed across companies.

On the assets side, these instruments are most often accounted for as ‘intangible assets’, followed by ‘inventories’ and ‘financial assets’. Some companies presented these instruments as ‘other assets’. Further, these instruments are measured at cost or at fair value (or a combination of both approaches). Some companies do not disclose their measurement approach at all. On the liabilities side, some companies recognise provisions on a gross basis, while others do so on a net basis.

The size of these instruments, as a percentage of total assets or revenues, varies considerably among companies without being significant for all companies. This indicates that the instrument’s magnitude is not the sole determinant for recognition and disclosure in the financial statements. Nevertheless, there is room for improvement to provide information in the financial statements about these instruments’ nature, function, intended use, useful lives, amounts and accounting policies to help users understand their relevance and financial effects on the company.

Relatively few auditors’ reports discuss issues around carbon-related instruments. Those that do tend to discuss issues relating to the exercise of judgement or the use of assumptions, such as accounting for carbon-related instruments, measurement of these instruments, impairment tests for assets, and changes in accounting policy.

It’s about keeping employees interested in the firms they work for and retaining good talent so that they can continue to grow with, and add value to, the company. After investing in the skills to develop good people, we want to strengthen work environments that keep them.

The Accountant: What attracted you to the role of an auditor when you first joined as a trainee?

Matthew Howard: When I first joined Crowe, what most attracted me to the role was the opportunity to go out and learn about various businesses and charities. This has not changed in the years I have been with Crowe as business understanding is still fundamental to carrying out and executing quality audits.

The other attraction to the role was working within teams and collaborating to carry out audits. This collaborative approach remains key to how we operate and carry out audits today. It is important for the on-the-job training to develop our teams and relationships.

Matthew Howard has extensive experience supporting a diverse portfolio of corporate and non-profit entities. His corporate clients are predominantly owner-managed businesses across a range of sectors, including manufacturing, retail, and consultancy.

The Accountant: How has the training for auditors changed over the years since you joined the profession?

Matthew Howard: Training has changed quite significantly over the years.

The fundamental principles in terms of identifying risks and designing work to address them has not changed, but the development of software to assist auditors in their work has been introduced.

We have seen a shift in training, where auditors are required to use these tools in their audit work – such as in data analytics and the testing of IT systems. This has required additional skillsets from auditors.

The Accountant: What are you most looking forward to in your new role as partner?

Matthew Howard: We have ambitious growth plans nationally and locally in Kent, and it’s exciting to anticipate how these plans will come to fruition in the next few years and to be part of that journey.

The Accountant: How do you see the role of the auditor developing in the future?

Matthew Howard: The audit landscape continues to evolve, and regulators are requiring higher quality audits across the board from all firms.

The role of the auditor in this changing landscape will require additional skills around the use of software to assist in their audit work.

The use of AI is a development in the sector, and it will be interesting to see how it will be integrated into the audit work we currently carry out, and what role the auditor will play in this.

The Accountant: What advice would you give to someone looking to begin a career in audit?

Matthew Howard: I would encourage anyone joining the profession to embrace all that the role provides.

The opportunity to learn how different businesses operate is something that attracted me to the profession, and helps trainees to become well-rounded chartered accountants.

The teamwork element should also be embraced as this is the key to learning and development from your colleagues. I have made many long-standing friends from my time in audit, regardless of whether they have stayed with Crowe or moved on to other ventures.

Working in audit has its challenges at times, but if you embrace what the role provides then you will have a successful career in the profession.

Main image: Matthew Howard has extensive experience supporting a diverse portfolio of corporate and non-profit entities. His corporate clients are predominantly owner-managed businesses across a range of sectors, including manufacturing, retail and consultancy.

Auditors

Auditors should:

- check the coherence of information in the financial statements and the narrative part of an annual report, and

- lend their technical expertise to support the development of globally applicable guidance for consistent accounting treatment of carbon-related instruments, and to help ensure the resulting accounting and disclosure requirements are auditable.

See here for the full report.