Audit Reform

IRBA: Promoting the audit profession in South Africa

As South Africa’s Independent Regulatory Board for Auditors (IRBA) continues its efforts to rebuild trust in South Africa’s audit profession, Joe Pickard hears from IRBA CEO Imre Nagy to learn more about the regulator’s efforts.

Earlier this year, IRBA concluded a three-city roadshow to provide a platform for dialogue on inspection outcomes, challenges facing the profession, and various initiatives that aim to support improvements to audit quality in South Africa.

Speaking at the Johannesburg leg of the roadshow, Shabeer Khan, National Treasury’s accountant-general and the Minister of Finance’s representative on the IRBA board, said: “As a country, we have lived through painful chapters; chapters where state capture, corporate failures and financial misconduct eroded trust and public confidence in the systems meant to safeguard our democracy.

“Those failures remind us that audit quality is not just a professional matter; it is a national imperative. And make no mistake; trust is the currency on which economies run. And therefore, at its core, audit is about selling trust.”

Antonis Diolas

Head of Audit and Assurance with ACCA’s Policy & Insights teams, draws on extensive experience in auditing across different countries, and industries to lead on ACCA’s global work on audit and assurance. He previously served as technical advisor at the IAASB and IFAC SMP Advisory Group.

Joe Fitzsimons

Leads ACCA policy work across Europe, Eurasia, the Americas, Middle East and the UK. He was formerly a member of the policy team at the Institute of Directors, where he led across a range of policy areas, including education and skills, EDI, and SME support.

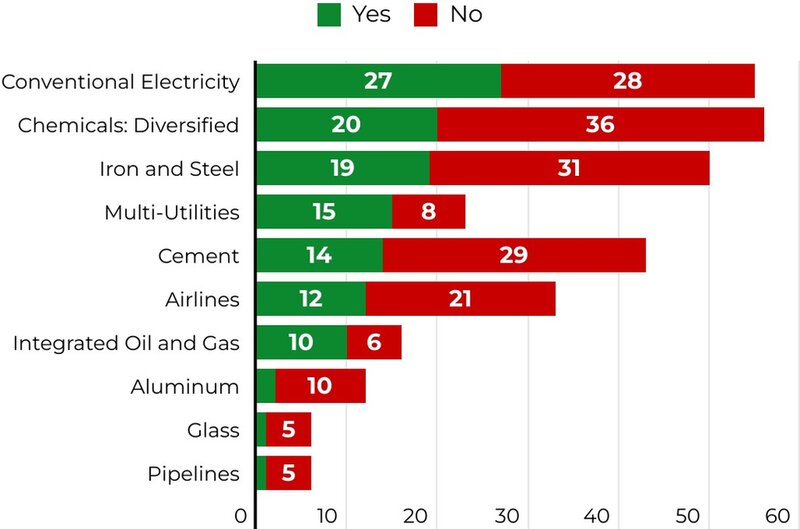

Engagement with carbon-related instruments are not concentrated in any subsectors.

Currently, there is no IFRS Accounting Standard or guidance dedicated to accounting for carbon-related instruments. Consequently, companies have had to develop their own accounting policies to account for these instruments as either assets, liabilities, income or expenses. As a result, several accounting treatments are observed across companies.

On the assets side, these instruments are most often accounted for as ‘intangible assets’, followed by ‘inventories’ and ‘financial assets’. Some companies presented these instruments as ‘other assets’. Further, these instruments are measured at cost or at fair value (or a combination of both approaches). Some companies do not disclose their measurement approach at all. On the liabilities side, some companies recognise provisions on a gross basis, while others do so on a net basis.

The size of these instruments, as a percentage of total assets or revenues, varies considerably among companies without being significant for all companies. This indicates that the instrument’s magnitude is not the sole determinant for recognition and disclosure in the financial statements. Nevertheless, there is room for improvement to provide information in the financial statements about these instruments’ nature, function, intended use, useful lives, amounts and accounting policies to help users understand their relevance and financial effects on the company.

Relatively few auditors’ reports discuss issues around carbon-related instruments. Those that do tend to discuss issues relating to the exercise of judgement or the use of assumptions, such as accounting for carbon-related instruments, measurement of these instruments, impairment tests for assets, and changes in accounting policy.

It’s about keeping employees interested in the firms they work for and retaining good talent so that they can continue to grow with, and add value to, the company. After investing in the skills to develop good people, we want to strengthen work environments that keep them.

The Accountant: How is the process of rebuilding trust in South Africa’s audit profession going?

Imre Nagy: The IRBA has seen significant headway and is receiving positive feedback from a variety of stakeholders including auditors themselves in various forums such as the quarterly Audit Quality Monitoring Forum whereby the IRBA engages with firms outside of the normal inspections process to discuss initiatives by the firms to improve audit quality.

The IRBA has also established a platform to engage with audit committee chairs through roundtable engagements with the largest six network firms in South Africa and their key audit clients to hear their concerns – this is an initiative that we plan to extend to the wider audit committee community in the near future and annually. This has been a positive initiative.

Naturally, it is harder to gauge broader public trust outside of formal engagements; however, in terms of media sentiment tracking, we have seen significantly less negative sentiment over the last couple of years.

A global Edelman survey in 2023 showed that trust in South African auditors increased from 74% in 2018 to 84% in 2023.

The Accountant: What is the importance of conducting roadshows?

Imre Nagy: The IRBA is fully committed to open and transparent engagement with stakeholders as part of its new five-year strategy and has further committed that these engagements should be impactful and collaborative.

It is key to our stakeholder engagement programme that both the IRBA and stakeholders should benefit positively from these interactions to align everyone around the imperative for high audit quality.

Furthermore, engaging the profession outside of a formal inspection helps drive proactive remediation. Registered auditors are proactively informed of some of the common pitfalls and can take appropriate remedial action where necessary.

We also find that auditors are much more engaging and open to discussion when not under the spotlight of a formal review, thereby fostering a collaborative approach to improving audit quality.

The Accountant: What is the public opinion of the audit profession in South Africa?

Imre Nagy: Without carrying out a public opinion poll or survey, it is difficult to quantify this. However, media and social media sentiment has changed over the last few years from predominately negative to negligible incidents of negative reporting or social media commentary.

The Accountant: What are the main challenges for auditors in South Africa?

Imre Nagy: Most firms would agree that challenges relate to the adoption of disruptive technologies, use of artificial intelligence in audits, and providing assurance on sustainability measures. These are regular topics of discussion, standards development, training and education competency conversations by not just the IRBA but also other regulators and professional bodies.

Another challenge that appears to affect firms globally is the attractiveness of the profession, which impacts attracting talent to accounting and auditing.

A further challenge we hear from smaller to mid-sized practitioners during our roadshows is the importance of balance when it comes to regulation. Many smaller firms feel overwhelmed by the level of compliance that must be achieved and therefore, a right touch approach to regulating the profession is of critical importance.

Our inspections, for example, are performed on a risk-based approach with more resources dedicated to those audit firms that take on a greater number of public-interest engagements.

Finally, preparers of corporate reports are not regulated to the same degree as auditors, placing pressure on auditors to report risks during an audit. National Treasury recently appointed the World Bank to do a follow-up review of the 2013 World Bank Report on Standards and Codes (Accounting and Auditing), which recommended the independent regulation of professional accounting organisations in the country.

The Accountant: What are the main opportunities?

Imre Nagy: The IRBA sees the main opportunities as being in these key areas: leveraging ethical and responsible implementation of AI; mandated sustainability reporting framework and assurance; fostering a thriving and attractive profession; and the adoption of advanced technology to enhance efficiency and audit quality, and reduce risk.

Technology has the ability to add efficiencies to the audit and, therefore, free up space for matters that require critical thinking, such as the application of professional scepticism. Moreover, technology has the potential to further enhance the attractiveness of the profession, especially by appealing to the youth who are well versed in the latest tech.

The discussion on sustainability assurance is still underway. However, with the upcoming International Standard on Sustainability Assurance 5000, there is room for the profession to play its part.

The Accountant: Is audit an attractive career path?

Imre Nagy: The IRBA focuses on the positioning of a career path in audit around the social impact and service to society, making an impact and improving investor confidence and ultimately benefiting the economy positively.

It is the IRBA’s belief that younger generations want to pursue meaningful careers that make a difference to society. In this sense it can be an attractive career option, coupled with the fact that very few careers offer exposure to such a wide range of industries and companies. Training to be an auditor provides a great springboard to careers in audit, finance or entrepreneurship.

However, we also note that the younger generation are digital natives and enjoy work flexibility, which is not always possible in an audit environment. Many South African firms have adopted hybrid and flexible working arrangements wherever possible, but they also note that it can have a negative impact on training. This continues to be an ongoing discussion.

The Accountant: What are the priorities for the IRBA for the next 12 months?

Imre Nagy: This is the first year of implementation of the new five-year strategy, which has three additional strategic pillars:

- To promote audit as a thriving and attractive profession;

- To carry out impactful stakeholder collaboration;

- To facilitate organisational development.

Therefore, the IRBA will focus on identifying capacity challenges in the profession, promoting the profession and initiatives that support the attractiveness of the career path.

It will also focus on continuing to enhance stakeholder interaction, developing user reports as tools for enhanced decision making, such as the current suite of reports that include the Public Inspections Report, the Enforcement Report, the Audit Quality Indicators Report and the newest report, the Reportable Irregularities Report.

These tools provide opportunities for dialogue and also serve as thought leadership for firms and users of audit opinions to engage around thematic areas requiring attention in the pursuit of sustained high audit quality.

The Accountant: How many auditors operate in South Africa?

Imre Nagy: There are almost 3,500 auditors registered with the IRBA.

Main video supplied by Berkan Turan/Creatas Video+ / Getty Images Plus via Getty Images

Auditors

Auditors should:

- check the coherence of information in the financial statements and the narrative part of an annual report, and

- lend their technical expertise to support the development of globally applicable guidance for consistent accounting treatment of carbon-related instruments, and to help ensure the resulting accounting and disclosure requirements are auditable.

See here for the full report.