Audit Ownership

Private equity and its impact on audit quality

With the growth of private equity (PE) investment in accountancy, the Institute of Chartered Accountants of Scotland (ICAS) has called for a multi-stakeholder review of the framework governing who can own audit firms. The Accountant hears from James Barbour, director of policy leadership at ICAS, to find out more.

ICAS’s call for a multi-stakeholder review follows the publication of a paper by the ICAS Private Equity working group, which examines the impact rules governing audit firm ownership.

ICAS CEO Bruce Cartwright said: “The audit profession is evolving at an unprecedented rate, driven by developments in AI, increasing focus on sustainability and global economic uncertainty. In fact, we expect more change in the next five years than we’ve seen in the past 50.

“As the landscape shifts, it’s crucial that government, regulators and professional bodies keep the public interest at the heart of any decisions. Audit plays a vital role in how capital is allocated in our economy, and that responsibility must guide any changes to the current framework.

“Our top priority is maintaining strong audit quality and auditor independence, regardless of where investment in audit firms comes from. That’s essential to ensure continued trust in financial reporting.”

Antonis Diolas

Head of Audit and Assurance with ACCA’s Policy & Insights teams, draws on extensive experience in auditing across different countries, and industries to lead on ACCA’s global work on audit and assurance. He previously served as technical advisor at the IAASB and IFAC SMP Advisory Group.

Joe Fitzsimons

Leads ACCA policy work across Europe, Eurasia, the Americas, Middle East and the UK. He was formerly a member of the policy team at the Institute of Directors, where he led across a range of policy areas, including education and skills, EDI, and SME support.

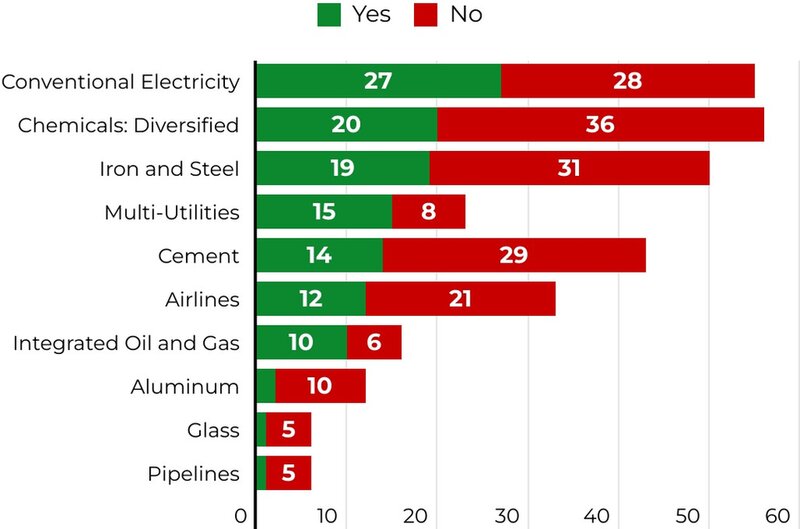

Engagement with carbon-related instruments are not concentrated in any subsectors.

Currently, there is no IFRS Accounting Standard or guidance dedicated to accounting for carbon-related instruments. Consequently, companies have had to develop their own accounting policies to account for these instruments as either assets, liabilities, income or expenses. As a result, several accounting treatments are observed across companies.

On the assets side, these instruments are most often accounted for as ‘intangible assets’, followed by ‘inventories’ and ‘financial assets’. Some companies presented these instruments as ‘other assets’. Further, these instruments are measured at cost or at fair value (or a combination of both approaches). Some companies do not disclose their measurement approach at all. On the liabilities side, some companies recognise provisions on a gross basis, while others do so on a net basis.

The size of these instruments, as a percentage of total assets or revenues, varies considerably among companies without being significant for all companies. This indicates that the instrument’s magnitude is not the sole determinant for recognition and disclosure in the financial statements. Nevertheless, there is room for improvement to provide information in the financial statements about these instruments’ nature, function, intended use, useful lives, amounts and accounting policies to help users understand their relevance and financial effects on the company.

Relatively few auditors’ reports discuss issues around carbon-related instruments. Those that do tend to discuss issues relating to the exercise of judgement or the use of assumptions, such as accounting for carbon-related instruments, measurement of these instruments, impairment tests for assets, and changes in accounting policy.

It’s about keeping employees interested in the firms they work for and retaining good talent so that they can continue to grow with, and add value to, the company. After investing in the skills to develop good people, we want to strengthen work environments that keep them.

ICAS has called for urgent action in these areas:

- Further review and study of the impact of private equity investment and other external capital providers in audit and other professional service firms, in the UK and abroad. A key focus of this would be recognising the risk that financial considerations can unduly influence behaviours;

- An open and balanced debate of the ownership requirements amongst key stakeholders, considering not only the role of private equity, but other models and approaches, including the scope for a more principles-based approach. The restrictions contained in the extant model are there to mitigate the threat that providers of capital will unduly look to influence behaviour. Therefore, any changes that are proposed will need to be assessed to ensure that they contain appropriate safeguards to mitigate this threat;

- Closer collaboration between auditor licensing bodies to make sure that the ownership requirements are being applied consistently, identifying and understanding the scope for audit firm structures that are compliant in form but not substance.

The Accountant: How much PE investment is currently being made into audit firms?

James Barbour: A recent report published by Accountancy Europe (Private Equity Investments in Accountancy Firms) indicates that while PE investment in accountancy has surged overall, audit-specific firms still receive a smaller share due to regulatory constraints.

The report suggests that around 40% of all PE transactions in European accountancy firms since 2015 involve firms that include audit and assurance services.

The Accountant: How do you anticipate this to grow in the future?

James Barbour: PE investment growth will depend on a range of factors, including economic conditions, perceived success of those already in this space, alternative opportunities for PE capital, technological and regulatory developments, and other sources of capital for firms.

The Accountant: Change in regulation can often be slow in the accountancy sphere. Do you believe regulation can keep up with the current rate of PE investment in the audit profession?

James Barbour: Change in regulation can be slow generally, partly because there is a need to ensure proper due process is followed. As we state in our paper, there would appear to be merit in revisiting the audit firm ownership rules to assess whether they remain fit for purpose but not just with a focus on private equity investment. We would also caution against a rush to change long-standing provisions without appropriate due process. Getting it right is more important than making any such change quickly, for example.

The Accountant: How does PE investment in UK audit firms compare to PE investment in other countries?

James Barbour: It depends on the country. Accountancy Europe’s report suggests that the UK is among the top three regions – along with the US and Nordics/Benelux – in terms of PE platform investment in accountancy firms.

The Accountant: How will PE investment disrupt the current partner model?

James Barbour: Only time will tell. The impact in those firms where investment has already taken place will depend on the terms and conditions of the deal.

The Accountant: The report suggests that PE Investment may be contributing to the decline in licensed firms. What impact will this have on competition within the market in the long-term if this trend continues or increases?

James Barbour: At present this is unlikely to have any real impact on the FTSE 350 audit market. In the area of the audit market in which investment is taking place, there has been some reduction in the number of audit firms active in this space. The longer-term impact remains to be seen and will depend on various factors.

Main video supplied by CreativaImages/Creatas Video+ / Getty Images Plus via Getty Images

Auditors

Auditors should:

- check the coherence of information in the financial statements and the narrative part of an annual report, and

- lend their technical expertise to support the development of globally applicable guidance for consistent accounting treatment of carbon-related instruments, and to help ensure the resulting accounting and disclosure requirements are auditable.

See here for the full report.

Main image: Aaron Saw, head of Corporate Reporting Insights – Financial, ACCA