Sustainability

Rising to the sustainability challenge

Sustainability assurance enhances stakeholder confidence in environmental, social and governance (ESG) disclosures. But what are the drivers of sustainability assurance? ACCA’s Joe Fitzsimons and Antonis Diolas write.

Akey emerging challenge for the oversight of capital markets across the globe is how to incorporate an appropriate oversight regime for the assurance of sustainability-related disclosures.

Those who have been involved in audit and its regulation for any time know the complexities and challenges that financial disclosures can pose for regulatory oversight. The rapidly emerging and growing sustainability assurance market poses equally tough if not tougher questions.

A sustainability assurance regime does not exist in isolation. Any framework needs to be placed in a wider context of supporting wider economic objectives promoting long-term economic growth, increasing investment, and strengthening financial and professional services.

In its recent submission to the UK government’s Department for Business and Trade (DBT) consultation on developing an oversight regime for the assurance of sustainability-related financial disclosures, ACCA said that the assurance regime should enhance the quality, consistency and credibility of sustainability disclosures which will improve investor access to reliable, decision-useful information. This is essential for mobilising private capital toward productive, innovative and sustainable sectors.

Governments and regulators are increasingly focused on building market confidence in sustainability information to support the transition to a greener economy. For policymakers an effective sustainability assurance regime must deliver several key outcomes including trustworthy and comparable sustainability disclosures, clear accountability for assurance providers and alignment with international standards.

While ACCA advocates for global standards to improve trust and consistency in accounting, we recognise that achieving this can be difficult in emerging areas. Jurisdictions are taking different approaches: while the UK has been consulting on a voluntary regime, other jurisdictions are moving to mandatory requirements: The European Union, for example, through the Corporate Reporting Sustainability Directive (CSRD); and Australia and New Zealand who are introducing mandatory requirements using a phased approach. Although others - notably the US are moving in the opposite direction.

However, this divergence largely relates to reporting requirements rather than assurance standards. In the area of sustainability assurance, there are currently few local standards, with most jurisdictions expected to rely on global frameworks such as the IAASB’s newly developed standard ISSA 5000 or ISAE 3000 (Revised) in the interim.

Whatever the status, any sustainability oversight regime should include mechanisms to assess whether sustainability assurance providers - regardless of background - demonstrate core skills and competencies ensuring there is a level playing field by applying consistent requirements for competence, ethics, and quality management.

Antonis Diolas

Head of Audit and Assurance with ACCA’s Policy & Insights teams, draws on extensive experience in auditing across different countries and industries to lead on ACCA’s global work on audit and assurance. He previously served as technical advisor at the IAASB and IFAC SMP Advisory Group.

Joe Fitzsimons

Leads ACCA policy work across Europe, Eurasia, the Americas, the Middle East and the UK. He was formerly a member of the policy team at the Institute of Directors, where he led across a range of policy areas including education and skills, EDI, and SME support.

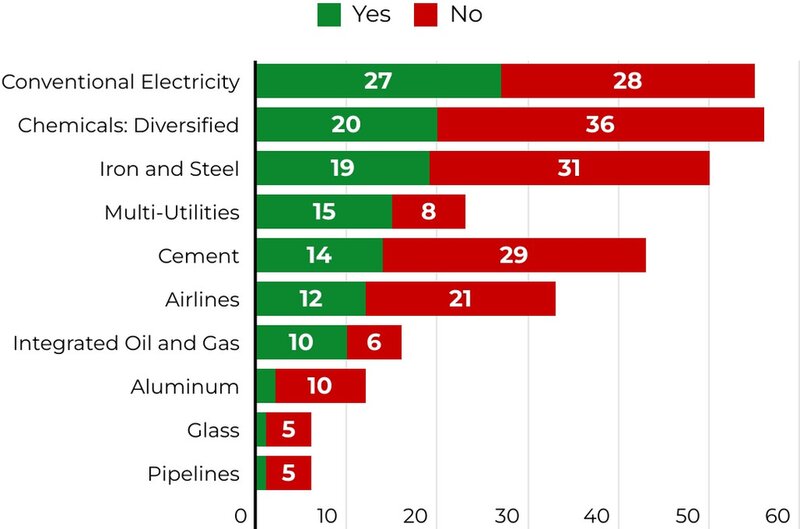

Engagement with carbon-related instruments are not concentrated in any subsectors.

Currently, there is no IFRS Accounting Standard or guidance dedicated to accounting for carbon-related instruments. Consequently, companies have had to develop their own accounting policies to account for these instruments as either assets, liabilities, income or expenses. As a result, several accounting treatments are observed across companies.

On the assets side, these instruments are most often accounted for as ‘intangible assets’, followed by ‘inventories’ and ‘financial assets’. Some companies presented these instruments as ‘other assets’. Further, these instruments are measured at cost or at fair value (or a combination of both approaches). Some companies do not disclose their measurement approach at all. On the liabilities side, some companies recognise provisions on a gross basis, while others do so on a net basis.

The size of these instruments, as a percentage of total assets or revenues, varies considerably among companies without being significant for all companies. This indicates that the instrument’s magnitude is not the sole determinant for recognition and disclosure in the financial statements. Nevertheless, there is room for improvement to provide information in the financial statements about these instruments’ nature, function, intended use, useful lives, amounts and accounting policies to help users understand their relevance and financial effects on the company.

Relatively few auditors’ reports discuss issues around carbon-related instruments. Those that do tend to discuss issues relating to the exercise of judgement or the use of assumptions, such as accounting for carbon-related instruments, measurement of these instruments, impairment tests for assets, and changes in accounting policy.

It’s about keeping employees interested in the firms they work for and retaining good talent so that they can continue to grow with, and add value to, the company. After investing in the skills to develop good people, we want to strengthen work environments that keep them.

These skills include:

Applying professional scepticism and judgement - this is vital in sustainability assurance engagements – where practitioners are required to assess evidence critically. Given the immaturity of sustainability reporting, it is likely to be even more important in sustainability assurance, where subjective statements often form part of sustainability reports and may not be backed up with sufficient appropriate evidence.

Acting in accordance with ethical requirements - auditors are bound by the International Ethics Standards Board for Accountants (IESBA) Code of Ethics for Accountants or by a local equivalent Code of Ethics and are regulated via their professional bodies. The ethical requirements and fundamental principles can foster trust when undertaking sustainability assurance engagements. Sustainability assurance providers may come across ethical dilemmas where experience gained from undertaking financial audits is relevant and helpful. While the nature of the ethical dilemma may be different, in the context of a sustainability assurance engagement, the fundamental principles of integrity, objectivity, professional behaviour, confidentiality, professional competence and due care that auditors shall follow are still relevant and applicable. The IESBA Code newly developed part 5 introduces provisions specifically for sustainability reporting and assurance and can be applied by sustainability assurance practitioners irrespective of background.

Quality management - To promote confidence and comparability, sustainability assurance providers should be subject to equivalent requirements for quality management — for example, adherence to the IAASB’s ISQM 1 framework — ensuring consistent standards of governance, ethics and performance across the profession.

Linking financial and sustainability information - The link between financial and sustainability information is of vital importance when providing assurance. Sustainability assurance providers with experience in financial audits are usually well placed to link the financial information that is reported in the financial statements with the information in sustainability reports. This helps them identify areas that could be more susceptible to misstatements. Additionally, their understanding of what is included in the auditor’s report can also provide them with further insights about areas that could be more susceptible to misstatements. For example, if the auditor’s report includes a key audit matter, and sustainability information relating to that matter is also reported in the sustainability report, then the assurance practitioner is likely to link the two and be more sceptical when designing the procedures to obtain sufficient appropriate evidence. This is especially relevant as the government wishes to ensure that investors have information they need to make informed decisions about the sustainability-related risks and opportunities that would reasonably be expected to affect an entity’s financial prospects. Therefore, any oversight regime should consider the communication between financial statement auditor and the sustainability assurance provider particularly in situation where a different firm is engaged to provide sustainability assurance.

Completing Continuous Professional Development (CPD) – second paragraph – ‘This is also why we launched our ground-breading, agenda-defining ACCA Professional Sustainability Diploma [Nov 2024]. The diploma is a world-leading qualification that equips accountants with the knowledge and skills they need to serve as experts and leaders in sustainability – including reporting and assurance, ethics and strategy.

This is also why we launched our ground-breading, world-leading, agenda-defining ACCA Professional Sustainability Diploma [Nov 2024]. The diploma is a world-leading qualification that equips accountants with the knowledge and skills they need to serve as experts and leaders in sustainability – including reporting and assurance; ethics and strategy.

There is a growing clamour across business for professionals who can answer this demand – and the diploma offers rich fields of new opportunity for accountants to pursue fascinating, satisfying and rewarding career paths. One of the landmark developments in sustainability assurance is the publication in November 2024 of ISSA 5000 by the International Auditing and Assurance Standards Board (IAASB) for sustainability assurance engagements. ISSA 5000 aims to increase trust in sustainability reporting and reduce the risk of greenwashing. Sustainability reporting is increasing around the world as more countries make it mandatory, especially for larger businesses. ACCA supports the ISSA 5000 which sets the global baseline for sustainability assurance which is why earlier in 2025 we published – along with CA ANZ – a practical guide on materiality for professionals in applying judgement when planning and performing sustainability assurance engagements under ISSA 5000. It’s critical that assurance practitioners focus on the most significant aspects of sustainability reporting, which are most likely to influence the decisions of intended users.

One of the important stances that we have taken on providing sustainability assurance is that the burgeoning profession should be open to all. ACCA has long been supportive of a profession-agnostic approach, where both accountants and non-accountants are permitted to provide assurance services, provided there is a level playing field when it comes to quality management standards, ethics, regulation and oversight. This approach recognises the broad and deep expertise required for the diverse and technical topics covered by sustainability reporting. The primary goal is to ensure high-quality assurance, which requires expertise in both assurance techniques and the relevant subject matter, including its measurement and evaluation. This approach – not confining assurance providers to any particular profession or qualification – also aligns with developing international practices.

As a leading global body ACCA tries to be at the leading edge in developing the services and skills the profession requires to remain relevant and add value in an increasingly complex world. In our 2023 report, sustainability assurance -rising to the challenge, we looked at the evolution of corporate reporting and how investors would be increasingly reliant upon sustainability information. It is becoming increasingly important that investors can trust that information.

The report concluded that the accountancy profession, alongside other professions performing assurance engagements, is well placed to satisfy the unprecedented demand for sustainability assurance.

ACCA continues to work hard on two fronts: first to ensure that the accountancy profession has the sustainability skills the capital markets require, and secondly collaborating with others to ensure sustainability regimes across the globe are fit for purpose.

Key factors driving a trusted regime for sustainability‑related disclosures

Building trust and credibility

Without independent oversight, sustainability disclosures risk being seen as mere marketing or greenwashing. An oversight regime provides assurance that reported information is accurate, complete and reliable, characteristics that come out of the playbook of how financial audits build confidence in financial reporting.

Protecting investors and stakeholders

It is clear from our work that investors increasingly rely on sustainability information to assess long-term risks and opportunities. Poor quality or misleading disclosures could result in poor investment decisions. Oversight helps ensure that stakeholders can make informed decisions.

Ensuring consistency and comparability

Any oversight regime has standardised application of reporting frameworks across companies and jurisdictions. This makes it easier for investors to compare sustainability performance between organisations.

Managing systemic risks

Climate change, environmental degradation, and social issues pose systemic financial risks. Reliable sustainability disclosures, backed by robust oversight, help identify and manage these risks.

Driving accountability

Oversight encourages companies to invest in proper data collection, internal controls, and reporting processes. This accountability helps drive progress on sustainability issues.

Main video supplied by senkaya/Creatas Video+ / Getty Images Plus via Getty Images

Auditors

Auditors should:

- check the coherence of information in the financial statements and the narrative part of an annual report, and

- lend their technical expertise to support the development of globally applicable guidance for consistent accounting treatment of carbon-related instruments, and to help ensure the resulting accounting and disclosure requirements are auditable.

See here for the full report.

Main image: Aaron Saw, head of Corporate Reporting Insights – Financial, ACCA