XERO - Thought Leadership

Guiding landlords through Making Tax Digital for Income Tax

By Stuart Miller, Director of Public Policy & Tech Research at Xero.

From April 2026, the way your landlord clients need to report on income tax is changing. For those earning more than £50,000 from property or a combination of property and self-employment, Making Tax Digital for Income Tax (MTD for IT) will become mandatory.

For many landlords, the leap to digital tax will feel daunting and they’ll be looking for an accountant or bookkeeper that can steer them to compliance. The new MTD for IT requirements will add a fresh layer of complexity to accounting and bookkeeping tasks, particularly for landlords that may have multiple, joint or inherited properties or income from both properties and self-employment.

Whether you’re a landlord specialist, or a practice that serves a broad range of clients, now is the time to get ready and prepare for the uptick in landlords that will need professional advice. So where do you start?

Baroness Margaret Ford

Chair of the CPIA

On a global level, much is changing in terms of philosophical views on the role of regulation. We are witnessing a real-time experiment in public policy. Views on the nature and value of regulation and assurance, on the face of it, are diverging sharply between the European Union and the United States. And in a post-Brexit UK, our approach has never been required to be more nuanced.

Large corporate failures from the previous decade exposed weaknesses in audit, reporting, and governance. The consequences were systemic, affecting pension holders, suppliers, and communities. Since 2018, the auditing landscape has evolved, resulting in improvements in audit quality, as evidenced by the Financial Reporting Council (FRC) data demonstrating continuous progress across the largest firms. The focus now centres on sustaining this momentum.

The CPIA brings something genuinely different to this debate, being an objective voice with a mission to improve audit quality and trust.

With independence as CPIA's North Star, the organisation asks difficult questions others might avoid. We challenge both the profession and its critics with equal rigour. Most importantly, we advocate for reforms that genuinely strengthen audit quality rather than simply adding regulatory burden to businesses or the firms that audit them.

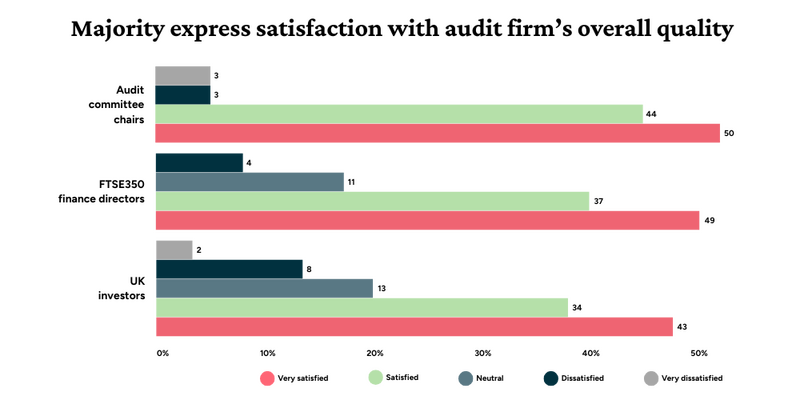

Our flagship Audit Trust Index (ATI), launched in 2024, measures and tracks perceptions of audit quality across three stakeholder groups: Investors, FTSE 350 finance directors and Audit Committee Chairs. The findings revealed audit quality's positive strides:

Russell Bedford International Young Partners & Managers Conference 2023

Prepare your foundation

Our research of over 1000 sole traders and landlords shows that a fifth (19%) have still not even heard of MTD for IT.* As a first step, identify which of your landlord clients will be impacted in the initial wave and start to prepare them for the changes ahead. Evaluate how they currently operate. For example, do they still rely on spreadsheets or shoe boxes for their record keeping? Are they already handling their own bookkeeping using digital tools?

Understanding each client's starting point will allow you to stagger onboarding, make sure they are comfortable with new digital processes and ease them into a new way of working. Look for opportunities to educate them - offer webinars, and share FAQs and one-to-one sessions that establish you as a trusted partner.

Establish your offering

In the run-up to MTD for IT, technology is likely to be a key area of focus and the new legislation will accelerate the shift towards other tech-driven processes. Think about the end-to-end process for MTD for IT - from the initial data collection to the final submission - and consider how internal workflows or processes can be optimised to nudge landlord clients towards digital record-keeping and get into good digital habits.

Look for a platform that is HMRC recognised, boosts efficiency, supports client collaboration and removes the need for multiple solutions. If done in the right way, accountants and bookkeepers are optimistic that MTD for IT will be a catalyst for better business practices, with streamlined processes (43%), improved cash flow management (34%) and reduced admin (32%) among the benefits listed. In time, stronger digital habits will lead to good financial health and for landlords this should mean it becomes easier to track rent payments, understand maintenance costs and quickly spot if clients are falling into arrears.

Price your services

Finally, it’s important to consider how to price your offerings for MTD for IT. You're going to be navigating new legislation, software and processes. You will likely need to consider multiple pricing models, depending on the requirements of your clients and capacity of your practice.

Once the dust settles on the initial transition, many practices will move towards a collaborative approach, where landlords complete some of the tasks themselves and advisors support them with the more technical, complex tasks. Adopting this approach should also allow accountants and bookkeepers to spend more time offering advisory and strategic insights, which will deepen ties between clients and their accountants.

Turning MTD for IT into long-term success

The road to MTD for IT may seem long and winding, particularly with so many landlords new to digital accounting or bookkeeping tools, However, early preparation will ensure smoother client onboarding, help you manage your workload effectively and support sustained growth.

You are also not alone in navigating the changes. As a trusted partner and platform, we have got you and your clients covered and will support you in confidently mastering MTD for IT. Take a closer look at our range of MTD-ready plans, which provide comprehensive support and offer accuracy and insights, while automating the admin. Or become a Xero partner and join over 250,000 accountants and bookkeepers benefiting from free software, training and dedicated support in their practice.

You can also check-out our step-by-step action plan which breaks down the journey to MTD for IT into clear phases and includes practical tips so you can know exactly what to do and when.

*Based on an online survey of 1000 UK Senior Decision Makers in SMEs (including sole traders) run by Opinium Research on behalf of Xero between 29 June 2025 and 11 July 2025.