Growth Trends

Global Trends in Audit and Advisory Growth

Collating three years of IAB World Survey data, IAB Data Researcher Bailey Rawden analyses audit and advisory revenue trends across global networks and associations, offering an objective perspective of how their principal service lines have continued to evolve over time.

This analysis provides a three-year overview of service line revenue growth across leading international networks and associations, covering the period from 2022 and 2024. The focus lies on the comparative movements in audit and advisory revenues, outlining year-on-year percentage changes and assessing the relative performance of each service area. The data highlights clear directional trends and the consistency of growth across organisational models, offering an objective view of how their principal service lines have evolved over time.

Antonis Diolas

Head of Audit and Assurance with ACCA’s Policy & Insights teams, draws on extensive experience in auditing across different countries, and industries to lead on ACCA’s global work on audit and assurance. He previously served as technical advisor at the IAASB and IFAC SMP Advisory Group.

Joe Fitzsimons

Leads ACCA policy work across Europe, Eurasia, the Americas, Middle East and the UK. He was formerly a member of the policy team at the Institute of Directors, where he led across a range of policy areas, including education and skills, EDI, and SME support.

Currently, there is no IFRS Accounting Standard or guidance dedicated to accounting for carbon-related instruments. Consequently, companies have had to develop their own accounting policies to account for these instruments as either assets, liabilities, income or expenses. As a result, several accounting treatments are observed across companies.

On the assets side, these instruments are most often accounted for as ‘intangible assets’, followed by ‘inventories’ and ‘financial assets’. Some companies presented these instruments as ‘other assets’. Further, these instruments are measured at cost or at fair value (or a combination of both approaches). Some companies do not disclose their measurement approach at all. On the liabilities side, some companies recognise provisions on a gross basis, while others do so on a net basis.

The size of these instruments, as a percentage of total assets or revenues, varies considerably among companies without being significant for all companies. This indicates that the instrument’s magnitude is not the sole determinant for recognition and disclosure in the financial statements. Nevertheless, there is room for improvement to provide information in the financial statements about these instruments’ nature, function, intended use, useful lives, amounts and accounting policies to help users understand their relevance and financial effects on the company.

Relatively few auditors’ reports discuss issues around carbon-related instruments. Those that do tend to discuss issues relating to the exercise of judgement or the use of assumptions, such as accounting for carbon-related instruments, measurement of these instruments, impairment tests for assets, and changes in accounting policy.

It’s about keeping employees interested in the firms they work for and retaining good talent so that they can continue to grow with, and add value to, the company. After investing in the skills to develop good people, we want to strengthen work environments that keep them.

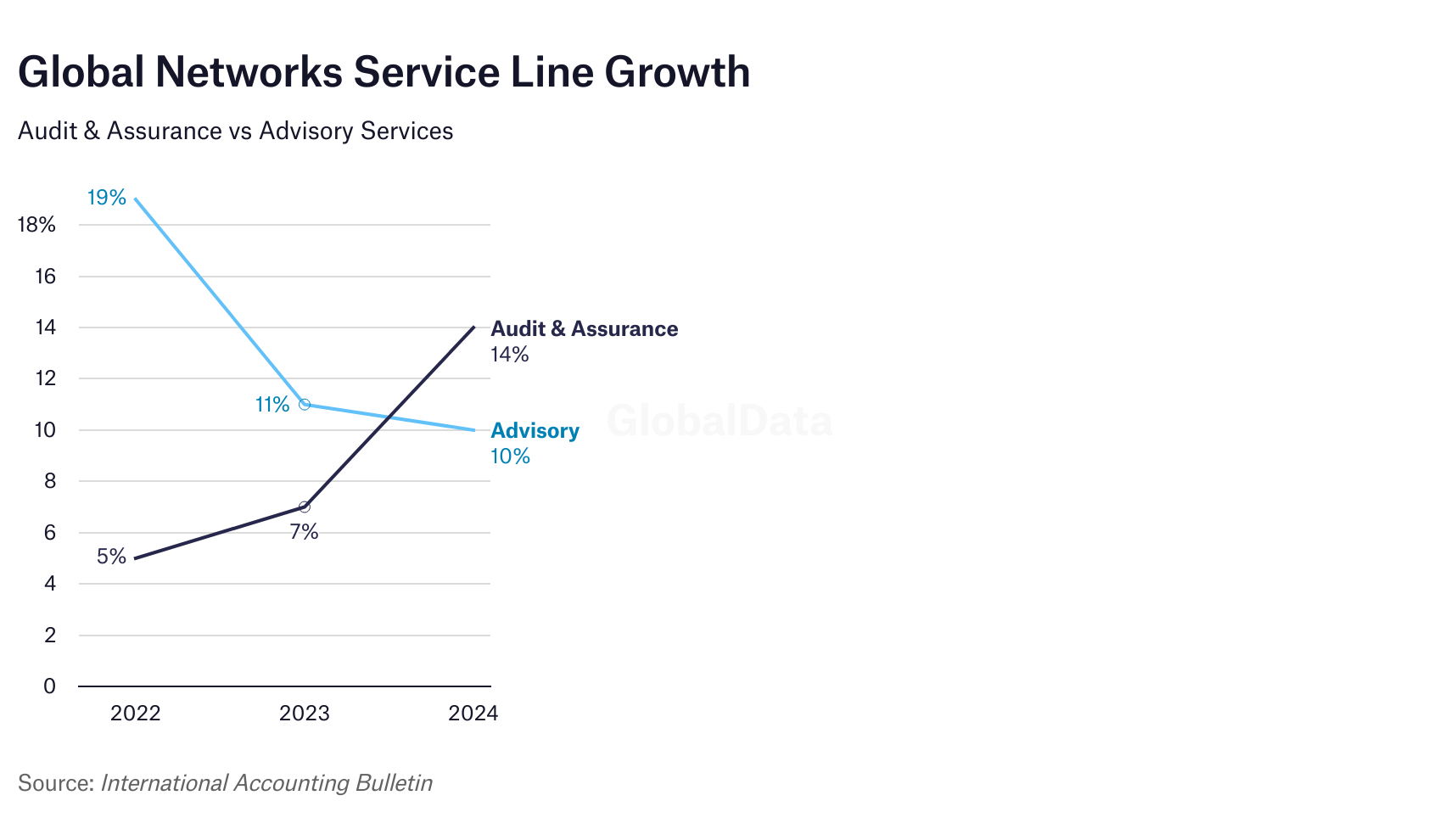

Networks

Over the three-year period, networks recorded strong and sustained revenue growth in both advisory and audit services. The data points to a broadly upward trajectory for both lines, with variations in momentum across the years. In 2022, advisory services led overall growth, expanding by 19%, while audit revenues increased by a more moderate 5%. This pattern established the baseline for subsequent years, where both service lines maintained positive development but at differing rates. In 2023, the data indicates a narrowing in growth differentials. Advisory revenues continued to rise by 11%, while audit growth strengthened to 7%. Both lines therefore maintained double and high single-digit increases, signalling consistent expansion across the network segment. By 2024, the trend had shifted more decisively toward audit. Growth in audit services accelerated to 14%, surpassing advisory’s 10% increase. This marked the first year in the period where audit outpaced advisory, resulting in a more balanced overall profile between the two. Taken together, the three-year data series illustrates that both service areas remained resilient and growth-oriented, with audit showing progressively higher momentum in the most recent year. Overall, the results for networks demonstrate steady expansion across the review period, underlying the sustained strength of both service lines. While advisory led the initial growth phase, the data suggests a gradual rebalancing of performance, with audit regaining comparative pace by the end of 2024.

Engagement with carbon-related instruments are not concentrated in any subsectors.

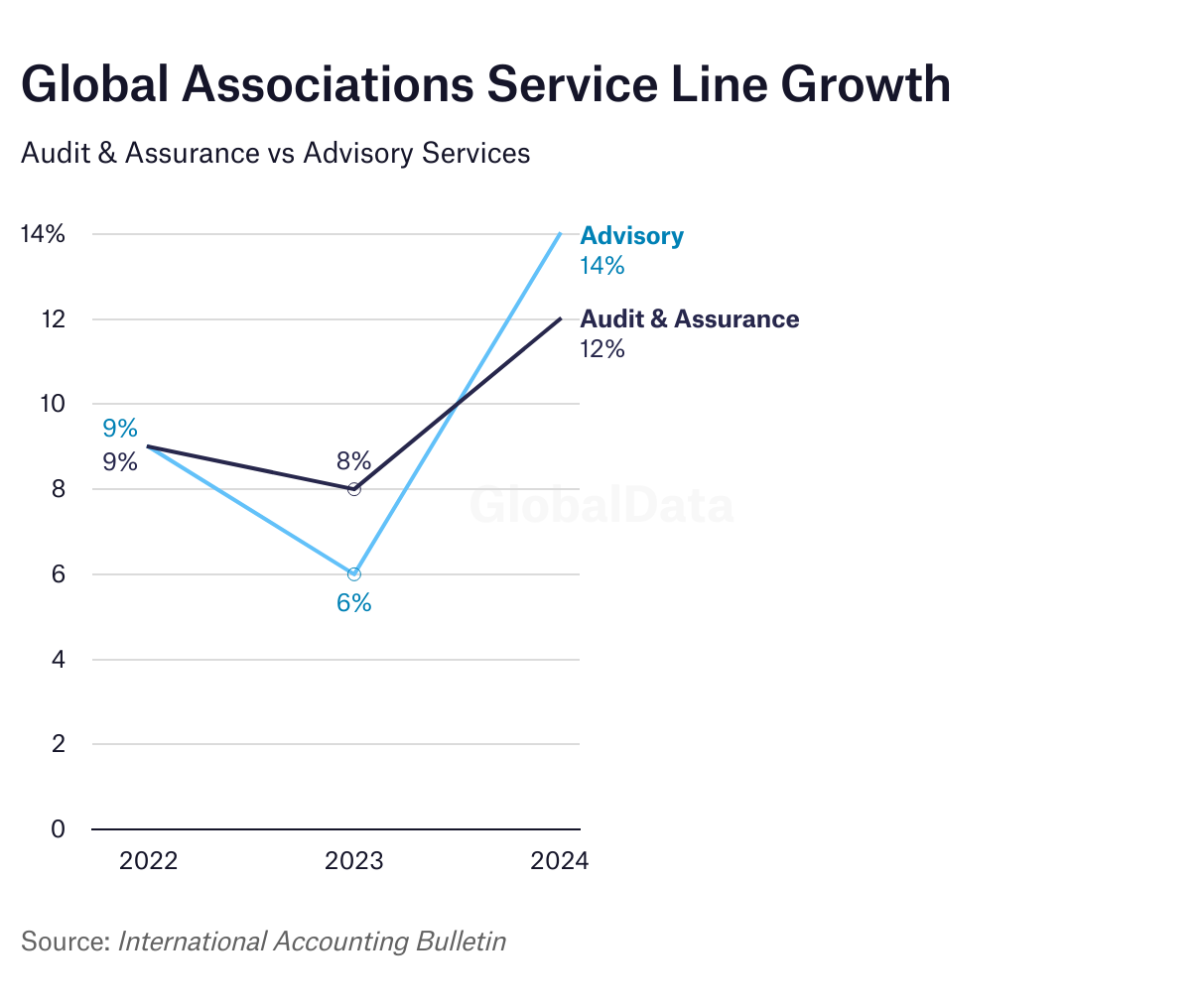

Associations

Associations also reported consistently positive revenue across audit and advisory services between 2022 and 2024. The figures show balanced growth at the outset, followed by steady improvement in both areas. In 2022, both audit and advisory revenues expanded by 9%, reflecting evenly distributed progress across the two core service lines. In 2023, audit continued to increase by 8%, while advisory rose by 6%, resulting in a modest divergence between the two. By 2024, both areas experienced their strongest results of the period. Advisory growth advanced to 14%, while audit recorded a 12% increase. The year therefore represented a clear uplift in overall performance, with advisory regaining a slight lead. Viewed across the full period, associations achieved uninterrupted year-on-year growth, with cumulative expansion across both service lines and a particularly strong finish in the latest year.

Engagement with carbon-related instruments are not concentrated in any subsectors.

Comparative Analysis

Across the review period, both networks and associations demonstrated sustained and broad-based growth in audit and advisory revenues. The results show a general pattern of upward movement, with varying leadership between service lines depending on the year. For networks, audit growth accelerated progressively over the three years, while advisory growth remained robust but moderated from its initial high point in 2022. Associations followed a slightly different path, with closely aligned growth in the first year, a modest divergence in the second, and a notable uplift in both audit and advisory revenues in 2024, with advisory marginally ahead. Overall, the data reflects strong performance across both organisational models. Each displayed a consistent capacity for expansion, supported by balanced development in their key service lines. The narrowing gap in growth rates between audit and advisory across both groups over the three-year period suggests increasing equilibrium between traditional assurance work and advisory activity. Both segments therefore close the period with positive momentum and a broadly stable distribution of growth across their core services.

Main video supplied by Anuphan Poolkoet/Creatas Video via Getty Images

Auditors

Auditors should:

- check the coherence of information in the financial statements and the narrative part of an annual report, and

- lend their technical expertise to support the development of globally applicable guidance for consistent accounting treatment of carbon-related instruments, and to help ensure the resulting accounting and disclosure requirements are auditable.

See here for the full report.

Main image: Aaron Saw, head of Corporate Reporting Insights – Financial, ACCA